A well-established universal healthcare system is widely regarded as one of the benchmarks of a country’s effective governance. When one is in place, you can be confident that the government truly cares for its citizens. Fortunately, the Philippines has a government-owned corporation that can take care of people’s health insurance in the Philippines.

The Philippine Health Insurance Corporation (PhilHealth) was established in 1995 with the aim of implementing universal health coverage in the country through affordable, acceptable, available, and accessible health care services to all Filipinos. It is mandated to be the means for the healthy to help pay for the care of the sick, and for those who can afford medical care to subsidize others who cannot.

PhilHealth and its beneficiaries have access to an extensive package of services that include inpatient care, ambulatory surgeries, and deliveries, among others. While this sounds good on paper, you can’t help but wonder if it’s enough to serve as the universal healthcare system we need from the government.

Is PhilHealth enough to address your current healthcare needs?

You can’t deny the fact that the government’s intention to establish PhilHealth is to help the Filipino people benefit from a universal healthcare program.

From an estimated 83% in 2004, the corporation not only managed to increase coverage by 86% in 2010, but it also reached almost “universal” coverage at 92% in 2016. It has also been reported that PhilHealth has increased access to primary healthcare services through its different packages while ensuring quality service through its own accreditation system.

But, despite the corporation’s noble purpose, there is much to be desired in terms of coverage. The level of financial protection provided by this social health insurance system is limited despite claiming success in boosting population coverage. In addition, it appears that what PhilHealth has been dishing out won’t be enough as a standalone health insurance service.

Learning the hard way

Just like how a company’s HMO isn’t enough to give you security, PhilHealth comes up short in covering medical expenses.

This is what freelancer and financial advisor Lianne Laroya learned the hard way when she found herself in the hospital emergency room back in 2013 for chest pains. She was given a painkiller and an antacid while spending two hours in the ER. Those already cost her over Php4,000. Her PhilHealth coverage was not used because she did not meet the minimum of 24 hours of confinement, according to the ER nurse.

Another freelancer and podcast manager, Florante Valdez, weighed in on the pros and cons of depending solely on PhilHealth for health insurance. He explained that it might be a sound investment since it provides subsidies like medication, lab exams, and operating room expenses, but you still have to shell out your own money to pay for hospital deposits, optometric services, and minor dental work.

Despite the many benefits PhilHealth offers, it’s still a smart move to look for the best options that can augment your health insurance plan. Our Medlife Protect Plus offers better coverage, proving that solely depending on PhilHealth won’t give you mileage when it comes to health insurance.

Still a long way to go

When President Rodrigo Duterte signed the Universal Health Care Act into law on February 19, 2020, it marked the beginning of the kind of healthcare reform Filipinos need in the country.

This new law automatically enrolls all citizens of the country in the National Health Insurance Program (NHIP), granting all “immediate eligibility” to a host of healthcare services focused on preventive, promotive, and curative care, among others. It also requires PhilHealth to include new services into its coverage, such as free consultations, lab tests, and diagnostic services.

However, the strain on resources brought about by the COVID-19 pandemic could possibly delay the implementation of the Universal Healthcare Law. And even when this law gets fully implemented, there’s still no certainty that it will be enough to achieve true universal healthcare.

The universal health care framework

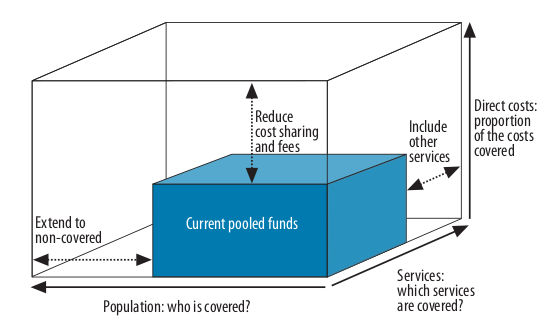

The World Health Organization (WHO) provided a cube diagram by which to consider three essential factors in measuring the effectiveness of a universal healthcare program:

- How much of the population is covered

- Which health services are covered

- What percentage of the total healthcare cost will be shouldered by the government compared to the patient