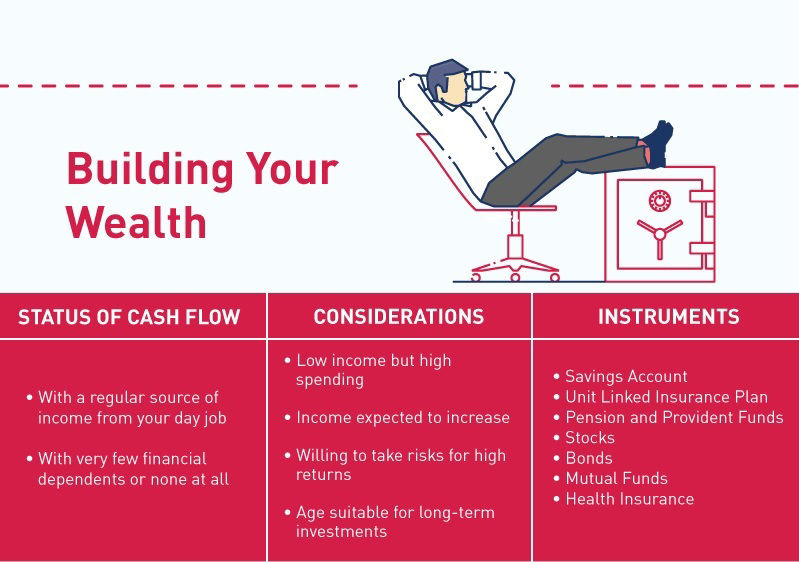

Building your wealth

At this stage, you’re starting to make your way into the workforce. You’re earning a fixed amount of salary, which you can augment by having business on the side or a part-time job. Your expenses are for your personal needs and are most likely to exceed your income.

The good thing in this life stage is that you’re young, which means you have a lot of time to make your investments work for you. Ideally, at this point, you are starting to build your savings fund by putting a fixed amount in it once or twice a month.

If you have minimal or no dependents at all, aggressive investing is recommended since you have a higher tolerance for investment risks. But if you’re a breadwinner, be a moderate investor.

Investment products like savings with insurance, mutual funds, stocks, and bonds are ideal at this age since they grow in value over time.

Getting married

When you reach the marrying age, you evaluate your investment plans anew. Here, you need to consider you and your spouse’s combined income and expenses.

Getting a life insurance should be one of your primary considerations since you’re still young and healthy, so you’ll pay lesser premiums. Life insurance policies are attractive with coverage extending to death and savings benefits.

Buying equities or stocks from public companies is also a worthy investment since the value of your investment capital increases along with an increase in the value of these companies. You can also earn money when you sell or trade your stocks.

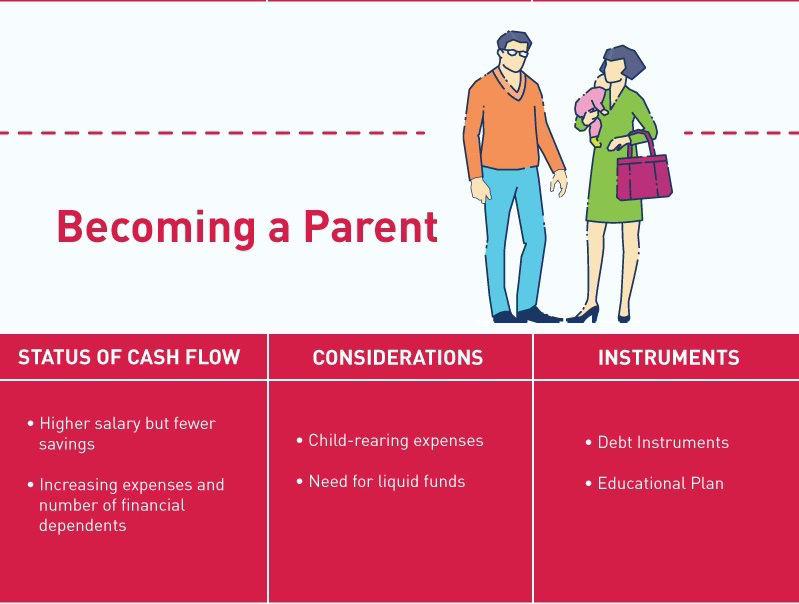

Becoming a parent

In this life stage, you might notice that your salary bracket is higher, but you’re saving less because you need to support your children. Getting an educational plan is one of the most practical things to do to prepare for when your children reach college.

At the same time, you might have a low threshold for investment risks. With family expenses piling up, it only makes sense to preserve your liquid assets or funds. Savings and time deposits fall under the category of debt instruments.

Although you only get a small amount of interest for keeping your money in the bank for a short period, you can readily gain cash earnings from your investments.

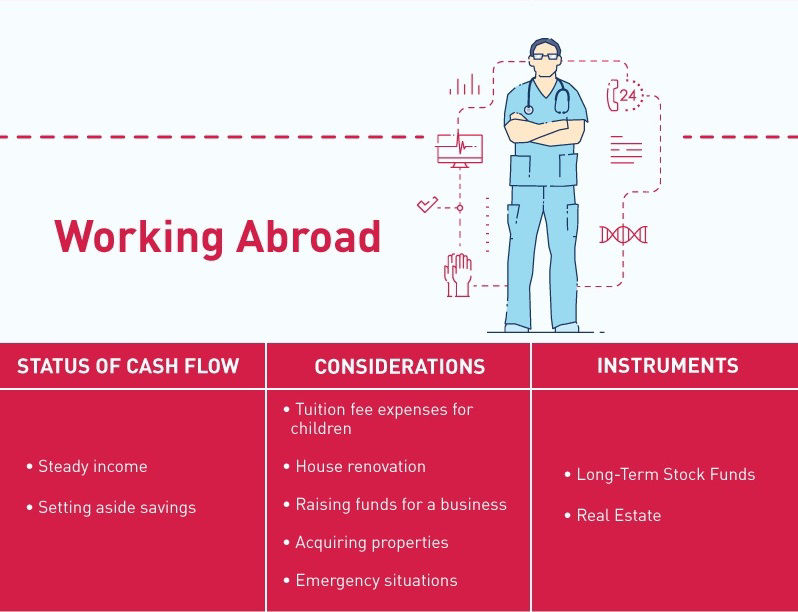

Working abroad

You or your spouse might decide to move to greener pastures, and for Filipinos, this usually means working overseas. Here, you get a steady source of income, and your savings fund may start to grow.

With good saving habits, you can afford to buy properties or upgrade existing ones. You can also use your real estate investments as an additional source of income if you decide to lease them out.

At this stage, you can go for long-term investments, which can take you 10 years or more before you see your gains. The stock market is a great investment you can make as it can provide a larger ROI than short- and medium-term investments. Plus, with a 10-year window for investing, you can considerably minimize your risks from stock market crashes, which can take longer to bounce back.

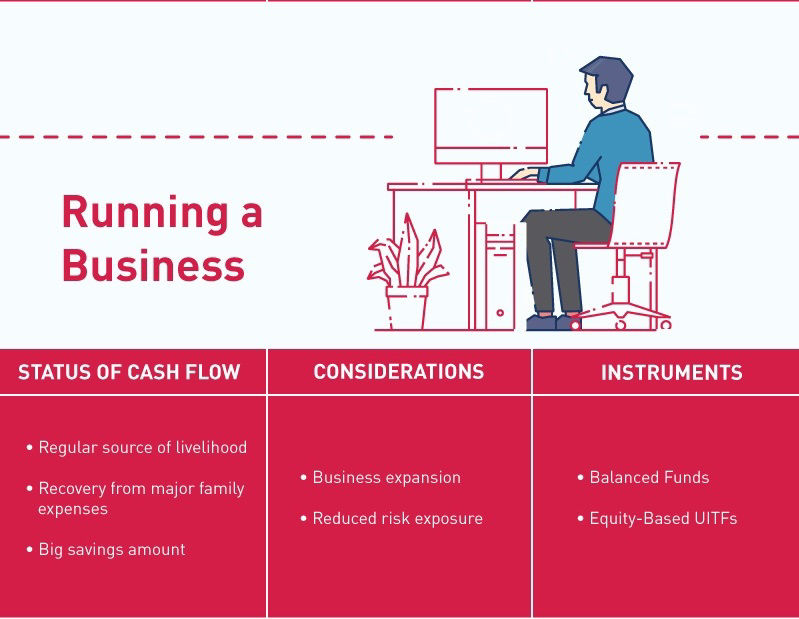

Running a business

By this time, you are saving more and starting to free yourself up from the burden of debt, recurring expenses, and other financial responsibilities. You’re halfway through the investment life stages, which also means you have about four to nine years to push your investments.

You can afford to go on the riskier side of investing since your goal is to earn more within this timeframe. At the same time, you’d want to mix it up with safe investments to balance things out.

Remember that your ROI will be proportional to the amount or level of risk that goes with your chosen investment. A good mix of investment may be balanced funds (a combination of conservative and high-risk holdings), along with equity-based funds that have purely high risks to them.

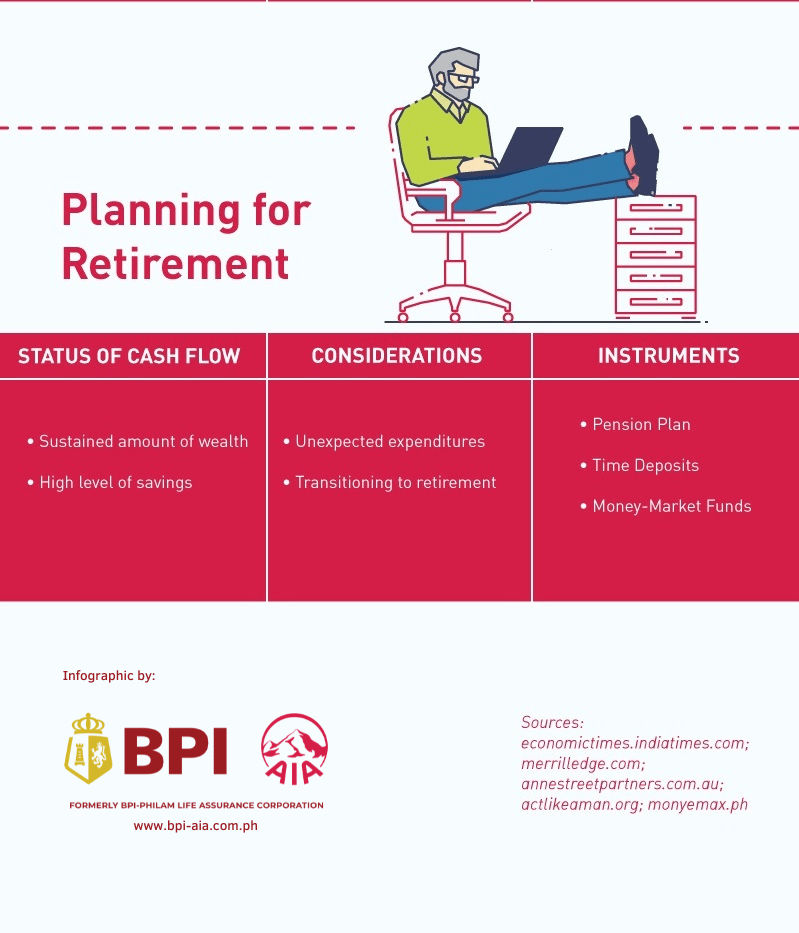

Planning for retirement

While you may be enjoying a sustained flow of wealth at this stage, you are still advised to invest early—even before approaching your retirement years—to ensure higher gains. When you retire, you cannot rely on pensions alone because these may not be enough to support your lifestyle needs and health expenses.

Since you are already preparing for retirement, choose short-term instruments. Your top options are those that will allow you to get your money back sooner. You could go for money-market funds and time deposits that give you a predetermined interest rate at a stipulated time or period. Check out the best rates in the market for higher returns.

If you know how to do it right, investing can reap great financial resources for you. There’s a host of investment products that can help you attain your financial goals for each stage in your life, but you need to be aware how much gain or risk you’re looking at.

Consulting with Bancassurance Sales Executives would be best to secure your finances no matter what life stage you’re at as they have your best interest in mind.